When the Euro surges on Monday - short it.

- James Tuffin

- May 7, 2017

- 2 min read

On Monday the Euro will rally strongly against the US dollar. This will happen for three reasons.

i) After Macron wins the French presidential election, market participants will close their Euro/USD short positions pushing up the price of the Euro.

ii) Other participants will be stopped out, further pushing up the price.

iii) New participants, excited by the rally, will look to join the party.

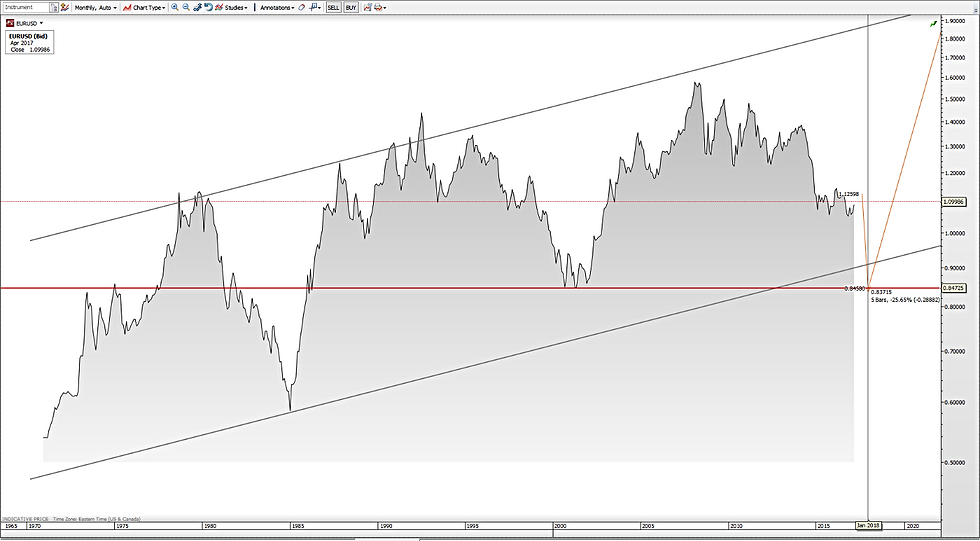

Visually it will look something like the below picture with the Euro rallying about 5% from the current 1.10 into the 1.15 area highlighted in red.

European and US Stock markets will also, initially rally.

After this surge, however, something strange will happen, the Euro will begin to fade, and stocks will pull back. By Tuesday it could be all over, with the Euro and the stock markets turning red.

The answer as to why this will happen is contained within the multi year EUR USD chart.

The above chart, courtesy of Saxo Bank, shows the Euro versus the Dollar since December 1970 through to present. (On the right hand side of the chart you can see the period of consolidation from 2015 through to now).

There is a lot that could be said about this chart, since it covers 47 years of history. Put simply, however, what it shows is the long term, gradual rise of the Euro versus the Dollar. Because this rise has been occurring over decades, it is not a story that fits in with the daily-news event analysis you see on Bloomberg or CNBC. However, it is there and it exists, and the outcome of the French Presidential Election has no bearing on the inevitable direction of travel that the Euro will take.

With this in mind, it is possible to forecast that the EUR/USD pullback which began in 2007, is not yet over and has further to run. Which is why the Euro rally on Monday will quickly fade.

The Euro will subsequently depreciate 25% against the dollar this year to somewhere around the 0.85 level. It will then rapidly turn around and move in the other direction, as the multi decade ascendancy of the Euro reaches its final stage. The Euro will, eventually, go to over 2 versus the Dollar. All of this can be predicted from looking at the long term charts.

Comments