Now is finally the time to start buying the US Dollar, but.....

- James Tuffin

- Oct 9, 2017

- 4 min read

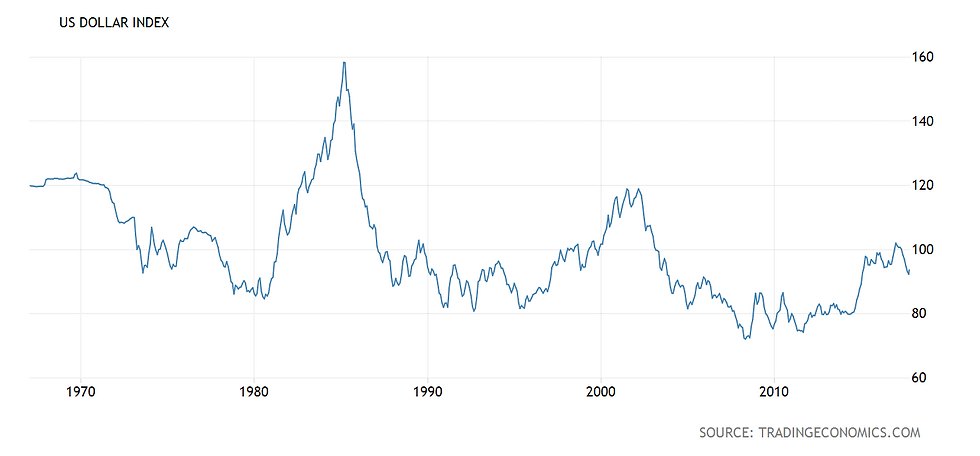

Since the beginning of 2017 I have emphasised in my blogs the immense significance of the multi decade United States Dollar chart, because of what it says about the long term credit worthiness of the USA as a country. Here is the chart again, showing the US Dollar Index from 1967 through to present.

So what is the significance of this chart? The answer is, all price action is part of an evolving pattern whereby previous price action influences future price direction. This chart shows a partially completed corrective (i.e. move to a weaker Dollar) pattern in the Dollar, which began in the early 1970s and, which, crucially, is still not completed.

Given what has already unfolded, the pattern will have two further significant movements: a rise to somewhere in the 130s and then a quick collapse to a new low somewhere around 60.

Finally, a movement from 130 down to 60 could not happen in isolation, therefore, the power of the final collapse suggests a corresponding debt shock, which in turn suggests terrifying levels of inflation.

There are some big conclusions in those previous three paragraphs. Moreover, pattern recognition, on which I have based these conclusions is not yet widely understood or accepted. For the benefit of the broader audience therefore, the purpose of this paper, is to explain why, (without reference to pattern recognition), the move up from the present level of 93, to 130 sometime in 2018, followed by a move down to 60 or lower is logical and inevitable, based on a review of long term and short term fundamental factors. The paper is not intended to be an academic paper but rather a look at some key pieces of data and historical comparisons to draw some common sense conclusions.

Multi Decade View

The value of the Dollar over time is influenced by a number of US specific and external factors, for example: GDP growth, growth in the money supply, interest rate expectations and inflation, sentiment, political stability and balance of trade payments. Endless commentary and forward projection could be made on the basis of these variables with further detailed discussion on their relative importance.

The one factor, however, that is the most important over the long term, in determining the relative value of a currency against its peers, is the level of debt and the corresponding credit worthiness of the country: If there are indications that the credit worthiness of a country is deteriorating then it is reasonable to conclude that there will be corresponding weakness in the currency.

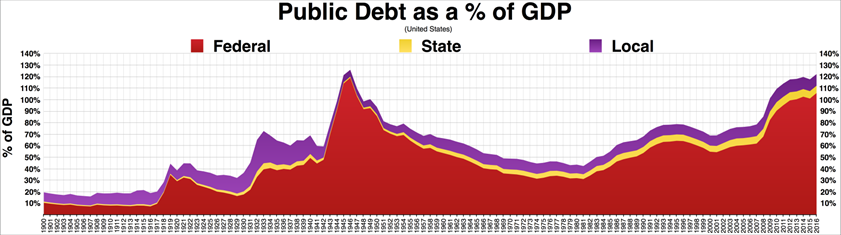

To illustrate the link between the value of the Dollar and the creditworthiness of the USA, the below chart shows the US debt to GDP since 1900 through to present.

https://www.usgovernmentdebt.us/spending_chart_1900_2020USp_XXs2li011tcn_H0sH0lH0f_Combined_Gross_Public_Debt

In the middle of the chart you can see peak (federal) debt to GDP after World War Two in 1946 at 118.90 percent , through to a low of 31.7 percent in 1981 through to the current levels of around 106 percent, plus state and local debt in 2017.

Referencing this chart against the previous dollar chart, there is an inverse correlation between the bottoming of the debt reduction in the 1970s and subsequent debt growth, to the same time period in the dollar index chart where I assert the dollar begins to weaken.

At this point the the counter argument could be made (Warren Buffet for example, October 2016, https://www.youtube.com/watch?v=iim4LG6pK64) that the current levels of debt are not as bad as they were after WW2, that the economy is just coming out of a long slow recovery and that as the economy grows the debt levels will recede. Therefore, there has not been a meaningful creditworthiness deterioration: the US was, is and always will be creditworthy.

The problem with this analysis from a historical comparison point of view is that the end of WW2 marked the end of the British Empire and the beginning of the American Empire. In other words it was a period of rebirth and renewal both politically, and physically in terms of public infrastructure building and new corporate job creation. The 2007/2008 Financial Crisis on the other hand, was not the ending of one world order to be replaced by another. Instead it was the continuation of the American Empire by the same generational and ruling parties and philosophies. There has been no intellectual, political philosophical or generational change in leadership. There has also been no physical rebuilding of public infrastructure or mass creation of middle class jobs.

Put simply, from a historical point of view we are currently at the end of one political and economic paradigm rather than the beginning of a new one and, therefore, high debt to GDP today, is much more worrying than it was in 1946. The debt and historical scenario gives the explanation of why the US dollar has been in a corrective pattern build up for 40 years.

The next 12 months

On a shorter term time frame the story reads slightly differently. There is global monetary policy tightening beginning, being lead from the US. The expectation, based on what the US Federal Reserve have said most recently is for one interest rate rise in the US in December, and a further three in 2018. The Federal Reserve has over promised and under delivered many times before: however, this time in my view I believe they will go through with it.

In contrast, it is unlikely, based on the official pronouncements that have been made, that other central banks in Europe and Asia will keep pace. I.e. interest rates will stay lower for longer outside of the US.

This matters because it will create a carry trade scenario whereby market participants will be able to borrow in Euros, Sterling or Yen to buy dollar assets. This trade will push up the value of dollar and also, to many people's surprise, US treasuries. Once this trade starts to feel like a one way trade, it will really get going along with equity markets.

When this happens and the economic mood lifts, however, remember the big picture - there is too much debt and there has not been the necessary political and societal renewal to move past this problem without debt cancellation and inflation.

Comments